Please answer the following math problem: Given a wall that is 30 meters long and 10 meters high, and a worker who can scrape putty on 100 square meters per day, how long will it take to complete the entire wall?

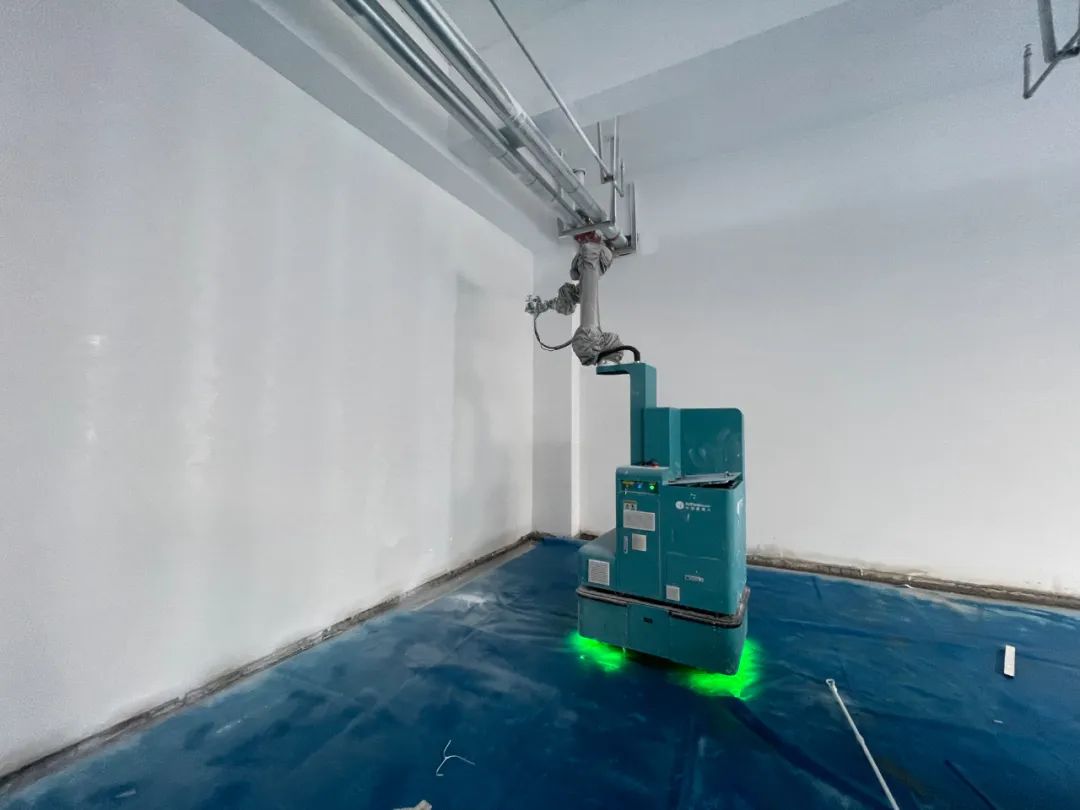

The answer is 3 days. However, if this question were answered by a robot, its response would be: 3 hours. This is not because the robot cannot do arithmetic, but rather a reflection of a technological revolution in the construction industry. Today, you can see robots on construction sites, wielding mechanical arms and using advanced sensors and control algorithms to precisely adjust the thickness of the spray. The workers beside them are only responsible for simple operations and monitoring.

With these "skilled" robot workers, up to 800 square meters of putty application can be achieved in a day, eight times the speed of human workers; and 3,000 square meters of latex paint application, twice the speed of handheld spray machines. More importantly, robots can accurately control material usage and ensure even spraying, saving 20%-25% on material costs.

Against this backdrop, digital transformation of the construction industry is an inevitable trend. Thanks to breakthroughs in core technologies such as artificial intelligence, visual sensors, and robot control algorithms, "robot replacement of human labor" has become a key competitive point, and the construction sector may become the "fertile soil" for the first industrialization of robots.

1

Construction Robots Remove the "Three Mountains"

First, the industry is facing a severe "labor shortage," primarily due to population aging and changes in the labor structure. The current construction industry in China is experiencing a clear "three-tier" dilemma: the 50s and 60s generation of migrant workers are about to retire; the supply of 70s and 80s generation migrant workers is insufficient; and there are very few 90s and 00s generation migrant workers. In the past two years, the total number of migrant workers has decreased by nearly 9.76 million, with a reduction of 6.5 million between 2022 and 2023, the highest in five years. Data from the National Bureau of Statistics shows that the average age of migrant workers has reached 43.1 years old, with an obvious aging trend. However, the work of older people is also restricted.

Local governments in many places have stipulated that men over 60 years old and women over 50 years old are prohibited from engaging in physical labor on construction sites. For example, Jiangsu Province once specifically stipulated that hiring "over-age" workers would lead to enterprises being placed under red code management.

This leads to the second contradiction: safety issues caused by manual construction. According to data from the International Labour Organization, the construction industry is the second most dangerous industry globally, after mining, with a fatal accident rate four times higher than that of other industries. Between 2011 and 2019, the number of construction worker deaths increased by 41%. In particular, the casualty rate among older workers is especially severe. For example, in 2021, there were casualties among migrant workers over 60 years old in Hubei and Jiangsu provinces. In addition to construction safety risks, many traditional construction processes are also harmful to human health. For example, during putty grinding, plastering, and pipeline spray painting, workers may inhale dust and harmful substances if they operate improperly, making them susceptible to occupational diseases.

The third contradiction is that outdated technology leads to low profit margins. Data released by the National Bureau of Statistics shows that the construction industry's output profit margin in 2023 was 2.64%, a decrease of 0.06 percentage points from the previous year. In contrast, the profit margin of the industrial sector is generally above 9%, and the profit margin of the secondary industry, which includes construction, is around 6%. First, construction efficiency is low, and workers are prone to monotony and boredom in repetitive labor, and may even make mistakes and rework due to fatigue or environmental interference. Second, the waste rate of building materials is high. The use of building materials relies on human control, which is not easy to grasp accurately. Statistics show that in the construction of an ordinary civil building, the waste rate of building materials can be as high as 40%. Moreover, it is difficult to recruit and retain skilled workers in the construction industry, and their wages are not a small expense.

Thus, labor shortages, safety issues, and low profit margins form a vicious cycle.

Real estate companies are now faced with two options: either switch industries and abandon the "sinking ship," which could lead to a direct "capsize" if the transition is too drastic; or actively seek transformation to enhance their competitiveness and seek change in quality.

On one hand, it is necessary to improve the competitiveness of residential business, especially when new projects are weak and the incremental market is limited, it is even more important to focus on cost reduction and efficiency improvement in the early stages; on the other hand, it is necessary to diversify real estate business types, including the development and operation of educational, elderly care, medical, commercial, and industrial real estate that are complementary to residential properties. This requires higher construction standards, and construction companies' demand for efficient and intelligent construction solutions is becoming increasingly strong.

In any industry, the final stage of competition often leads to a "great reshuffling," and technology is often the variable that is introduced.

This time, the construction industry has turned its attention to robot technology.

"Robots can first assist and replace 'dangerous, labor-intensive, dirty, and heavy' construction operations in production, construction, and maintenance," said a person from the Ministry of Housing and Urban-Rural Development. From the perspective of construction efficiency, construction robots have stable output efficiency and high standardization, effectively avoiding errors caused by manual construction, and are not limited by the physical strength of traditional construction workers. In terms of engineering quality, based on high-precision laser recognition systems, construction robots have higher construction accuracy and better construction quality compared to traditional manual methods.

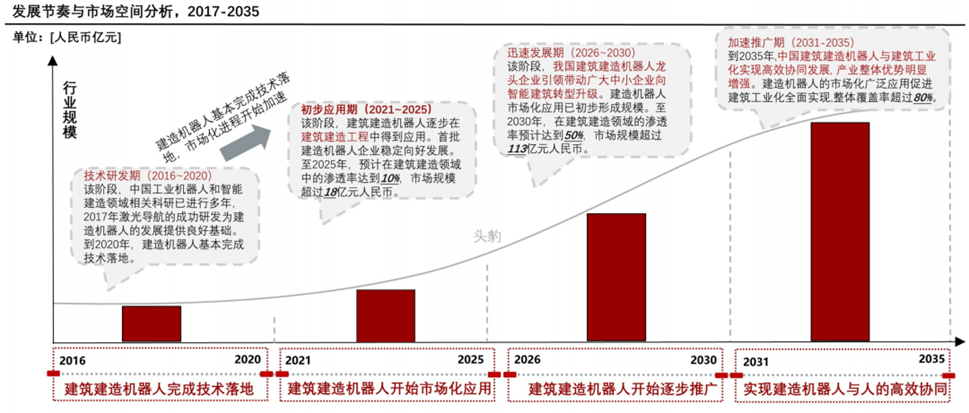

In terms of labor and material savings, construction robots are more environmentally friendly and low-carbon. For example, they can effectively collect dust during construction to achieve dust-free operations. Additionally, construction robots can improve material utilization through precise supply control programs, avoiding waste caused by insufficient precision.To address labor shortages, construction robots not only replace older workers but also attract younger labor back to the construction industry by significantly improving working conditions. In the future, construction workers will no longer be dusty bricklayers or plasterers. Instead, they will take on new roles as construction robot operators and site inspectors, working in a networked environment.Driven by the urgent need for "robot replacement of human labor," the global construction robot market is expected to experience significant growth. Straits Research predicts that by 2030, the North American market for construction robots will reach $54 million, while the European market will approach $52 million. Currently, Europe leads with 1.2 robots per 10,000 construction workers, the US has 0.2 robots, and China has only 0.1 robot, indicating the huge potential and growth space in the Chinese market.Report Linker further forecasts that the global construction robot market will grow from $331.7 million in 2023 to $681.8 million by 2028, with a compound annual growth rate of 15.50%. The Asia-Pacific region, especially China, is becoming a key driver of market growth.Data from the National Bureau of Statistics and the Ministry of Housing and Urban-Rural Development, analyzed by the Head-Leopard Research Institute, also shows that as of 2021, the market penetration rate of construction robots in China was less than 1%, but it has begun to enter the market application stage. It is expected that by 2025, the penetration rate will reach 10% with a market size exceeding RMB 1.8 billion; by 2030, the market size is projected to exceed RMB 11.3 billion with a penetration rate of 50%; and by 2035, the market size could reach RMB 22.4 billion with a penetration rate of over 80%, demonstrating a rapid growth trend.

2

"From project approval, foundation and base pit construction, main structure, roof piping to final delivery and acceptance, the entire construction process can be divided into 20 major categories, totaling 261 individual procedures, all of which involve interwoven processes and interactions between personnel and working environments," said Xu Junjie, General Manager of Tengyun Zhihui, the technology-enabled residential company under Century Golden Source.

When we map these 261 procedures to construction robots, we see the emergence of various types of robots, such as measurement robots, bricklaying robots, line-drawing robots, rebar-tying robots, ground-leveling robots, and painting construction robots. "Nowadays, apart from the relatively mature measurement robots, painting construction robots have taken the lead in transitioning from the nascent stage to the growth stage, thanks to their high degree of standardization, relatively friendly working conditions, and continuous working surfaces. They are also the first to achieve mass production and market entry," said Xu Junjie.

Why is this the case? Let's start with an example of a "fast-advancing" robot—mobile robots. These robots have been able to quickly proliferate in the industrial field because the warehousing and production line spaces are structured. They only need to operate in fixed scenarios, follow fixed routes, and perform fixed actions every day, which is relatively much easier.

Take the rebar-tying robot as another example—a "laggard" in this context. From the perspective of cost reduction and efficiency improvement, the high wages and scarcity of rebar workers make this occupation a key position for "robot replacement of human labor." However, at present, rebar robots can only perform some simple tying tasks. This is because they are unable to navigate through the unstructured construction site to replace the most labor-intensive tasks of rebar workers—rebar transportation and layout.

Thus, we see the biggest "stumbling block" on the path to the widespread adoption of construction robots—the unstructured nature of construction sites.This is actually a "Catch-22" situation. On the one hand, the construction industry is still in a semi-mechanized stage and has not yet reached the level of automation, let alone intelligence. Ideally, for all construction robots to be positioned to leverage their strengths, an automated environment is a prerequisite.On the other hand, automation itself presupposes a structured construction scenario. To apply automation to an unstructured environment, "intelligence" is required. This "intelligence" includes the ability to recognize and perceive walls, columns, and other obstacles, as well as the robot's capacity for autonomous judgment, decision-making, and execution.But can the current level of "intelligence" navigate freely in the complex and ever-changing construction site?At least, from the perspective of current perception technologies, it has not yet reached the level required for large-scale deployment on construction sites. For example, when you want to deploy some "ground-based" robotic assistants, you still need workers to clean up construction waste and change the sequence of operations before starting work.But what if we change our approach and create a "pseudo-structured" scenario? That is, instead of focusing on the "cluttered" ground, we shift our attention to the "empty" walls.

Today, policy support for the construction robot industry is also increasing continuously. In 2023, the Ministry of Industry and Information Technology, together with 16 other departments, issued the "Implementation Plan for the 'Robot+' Application Action", which proposes to focus on the development of robot products for measurement, material delivery, rebar processing, concrete pouring, floor and wall decoration, component installation and welding, and electromechanical installation. The plan aims to deepen the application of robots in the construction field and other scenarios. In the "Beijing Action Plan for the Innovative Development of the Robot Industry (2023-2025)", the construction sector is also specifically highlighted as a key area of focus.

With the starting whistle blown for "robot replacement of human labor," construction robot companies are not grappling with whether to participate, but rather how to take the lead.

3

Israel's Okibo is suitable for paint spraying, drywall treatment, and plastering. In addition to accurately identifying application areas and pre-planning work paths, Okibo's "standout feature" is its autonomy and independence. When starting work, only one worker is needed to guide Okibo into the room using a control panel, fill it with paint, and then start and monitor the output. There is no need for manual programming or prior knowledge of the room's structure.

(The Israeli Okibo robot)

(The Israeli Okibo robot) (The US-based Paintjet robot)

(The US-based Paintjet robot) (The US-based Canvas robot)

(The US-based Canvas robot)Compared to overseas companies, domestic construction robot enterprises started their exploration later but have caught up quickly. Driven by the pressure of industry transformation and national policies, they have completed the initial construction robot industry chain.

Among them, it is necessary to mention Boticellin, hailed as the "Whampoa Military Academy" of construction robots. This wholly-owned subsidiary of Country Garden Group has invested over one billion yuan in R&D and cultivated numerous "cross-disciplinary talents." Some outstanding representatives, after "graduating" from Boticellin, have also successively established their own robot companies, providing an "accelerator" for the industrialization of domestic robots.

Focusing on the track of painting construction robots, start-ups have become the "vanguard." Players include Zhucheng Technology (Shenzhen), Weijian Technology (Shanghai), FulltimeRobotics (Shenzhen), Dafang Intelligence (Shenzhen), and Fangshi Technology (Suzhou). In addition, "comprehensive players" represented by Boticellin have also developed painting construction products.

With his profound industry experience, Li Zike observed that information technology products, as management and efficiency tools, have improved the efficiency of construction industry managers in tasks such as drawing, calculation, and project management. However, in the actual construction process, there is still a heavy reliance on manual labor. The degree of automation of production tools is low, and there has been no significant change in production efficiency and costs compared to the past.

"After a series of preliminary research and technical pre-studies, we chose large-scale, standardized painting construction as our entry point and were the first to launch an indoor painting construction robot. It features functions such as putty spraying, scraping, grinding, dust collection, and latex paint spraying, covering all processes and scenarios of indoor painting construction in buildings," said Li Zike.

Today, FulltimeRobotics has achieved small-scale mass production, secured orders worth tens of millions, and successfully applied its robots in multiple projects worldwide, with a cumulative construction area exceeding 500,000 square meters. Domestically, the products are sold or leased directly and through channel partnerships to various public and commercial construction projects. Overseas, the main markets are Singapore and Europe. In Singapore, the FulltimeRobotics team has customized and rapidly delivered products tailored to local construction techniques, becoming the first spray robot supplier to pass local validation. Additionally, they have developed a compact, multi-angle spray robot suitable for Singapore's narrow spaces.

Gripping cutting-edge technology as the handle, but valuing commercial implementation even more, and finding solutions based on scene-specific issues, is the key for construction robots to be implemented first. As the company's founder and CEO, Li Zike, said, "There are few markets in the construction industry that reach a scale of 30 trillion. So, what the construction industry lacks is not technology or scenes, but the ability to solve problems."